Вавада казино регистрация на зеркале

Ярко-красный логотип бренда известен всем гемблерам Российской Федерации и далеко за ее пределами. Путь к популярности занял не так много времени, но усилий приложено немало. Создатель проекта Макс Блэк захотел сделать комфортную, безопасную и наполненную различными азартными развлечениями платформу и выполнил задачу. Сначала его усилия оценили пользователи из стран СНГ, но в последние несколько лет онлайн казино Вавада огромными темпами расширяет аудиторию. Игроки пользуются сайтом, переключая интерфейс на разные языки. Среди языковых версий находится 18 вариантов. Открывают кошелек, выбирая национальную денежную единицу или криптовалюту. Без проблем проводят платежи, применяя карты международных систем, криптовалютные и цифровые сервисы.

Гости и клиенты портала знакомятся с игротекой, где собраны более 5 тысяч игровых автоматов с высокой отдачей. Они играют в слоты с классической многолинейной механикой и современной кластерной функцией выпадения выигрышных комбинаций. Заходят в настолки, чтобы запустить виртуальную игру или трансляцию с живыми дилерами. Переходят в раздел турниров, вступают в борьбу за денежный приз и авто премиум класса.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Реальные отзывы о Вавада: какими преимуществами привлекает веб-казино

Среди клиентов заведения тысячи игроков. Они активно делятся впечатлениями о пребывании на платформе, выделяя ее плюсы и минусы. Недостатки администрация старается устранить в короткий срок, преимущества — усилить и приумножить. В ряде достоинств клуба выделяются следующие:

- Работа на основании лицензии Кюрасао. Этот документ дает пользователям гарантии честного геймплея, выплат выигрышей в полном объеме и конфиденциальности персональной информации.

- Наличие мотивирующих программ. После регистрации на официальном сайте Vavada каждый геймер становится участником систем привилегий и выплат бонусов. Проявляя активность в игровом процессе, они пользуются бесплатными ставками, расширенными суточными лимитами на вывод, допуском на розыгрыши без финансовых трат и услугами личных менеджеров.

- Возможность играть в демо. Этот режим предлагает вместо денежных средств тратить виртуальную валюту.

- Щедрые RTP и множители. Отдача симуляторов находится на уровне 94-98%. Она соответствует действительности, поэтому при запуске игр пользователи могут рассчитывать на гарантированные заносы с умножением до х50000 и выше.

- Вывод средств без верификации. Игрокам не обязательно подтверждать личность, чтобы играть на деньги и оформить кэшаут.

- Круглосуточная поддержка. Операторы чата принимают обращения круглые сутки. Скорость отклика не позволяет заявители ждать ответа больше 30 минут.

Эти факторы делают случайных посетителей постоянными клиентами, дают возможность беззаботно проводить время в любимых симуляторах.

Вход и РегистрацияЗеркало Вавада — играть без ограничений и блокировок

Российским гражданам приходится сталкиваться с затруднениями при входе на игровую площадку, так как на территории их страны онлайн-гемблинг вне законодательства. По этой причине базовый ресурс и рабочие зеркала, которые попадаются интернет-провайдерам, блокируются. На такие случаи разработчики компании создают новые отражения оригинального сайта, обеспечивающие доступ к играм и аналогичные функциональные возможности. Они продолжают работу в штатном режиме, чтобы новоприбывшие смогли зарегистрироваться, а действующие пользователи — авторизоваться в сервисе по имеющимся данным и восстановить доступ к аккаунту.

И те и другие находят актуальное зеркало casino Vavada с помощью поисковых систем браузера, обращаются в саппорт по электронной почте или переходят в официальные сообщества азартного клуба на страницах Вконтакте, Телеграм и Инстаграм. Последний способ самый быстрый и удобный. Модераторы обновляют списки URL в публикациях и выполняют функции техподдержки, предоставляя зеркала по запросу.

Список рабочих зеркал Вавада

Регистрация аккаунта Vavada и его функции

По правилам заведения завести учетную запись вправе только люди старше 18 лет. Несовершеннолетним доступны бесплатные демо-версии барабанов, которые не требуют регистрации и денежных трат. Если ваш возраст соответствует требованию, открывайте браузерную или портативную версию сайта и нажимайте кнопку красного цвета. В окне регистрации заполните всего две строки: электронной почтой (она станет логином) и придуманным паролем. Затем выберите валютную единицу для расчетных транзакций и подтвердите ознакомление с правилами клуба Вавада. Чтобы первый раз авторизоваться, нажмите «Регистрация» и выполните вход на платформу как зарегистрированный пользователь.

Не откладывая найдите взглядом кнопку в виде фишки. Кликните по ней, чтобы открыть личный кабинет и пройдитесь по его разделам. Среди них:

- Профиль. На странице необходимо подтвердить логин (указанный при регистрации имейл), заполнить персональную анкету и настроить двойную аутентификацию, если есть желание дополнительно защитить аккаунт. При потребности здесь выполняют верификацию и смену пароля.

- Кошелек. Раздел для выполнения денежных операций.

- Бонусы. На баланс бонусной вкладки зачисляются бездепозитные и депозитные вознаграждения. В специальном окне активируются промокоды.

- Статусы. Вкладка отображает уровни программы привилегий. Всего их шесть: новичок, игрок, бронза, серебро, золото, платина. Чем выше статус, тем большим числом преимуществ можно воспользоваться. Для повышения ранга потребуется потратить от 15$ до 50000$ на ставки.

- Сообщения. На странице хранятся уведомления администрации. При возникновении вопросов можно воспользоваться кнопкой обратной связи.

Функционал личного кабинета клиента заведения охватывает все задачи, требуемые для комфортного использования сервиса.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

Бонусы Vavada Online для всех игроков

Vavada предусмотрела поощрения и для новоприбывших и для завсегдатаев заведения. В число подарков входят спины, фишки и деньги, которые обеспечивают ставки без расходов и повышенную прибыль. Ее нельзя просто так вывести, потребуется отыграть куш за настоящую валюту с определенным коэффициентом. Но выполняя это требование, игроки ничего не теряют. Делая ставки и вращая барабаны, они срывают еще больше заносов и забирают крупные выигрыши.

В бонусной программе действуют четыре вида вознаграждений.

Бездепозитный бонус за регистрацию

Это презент для приветствия новичков в виде 100 фриспинов, которые доступны для использования только в слот-машине под названием Great Pigsby Magaways. Вращения активируются при аутентификации нового игрока и действуют ограниченное время — 14 дней. Если их не потратить и не прокрутить выигрыш с вейджером х20, то bonus Вавады просто самоуничтожится.

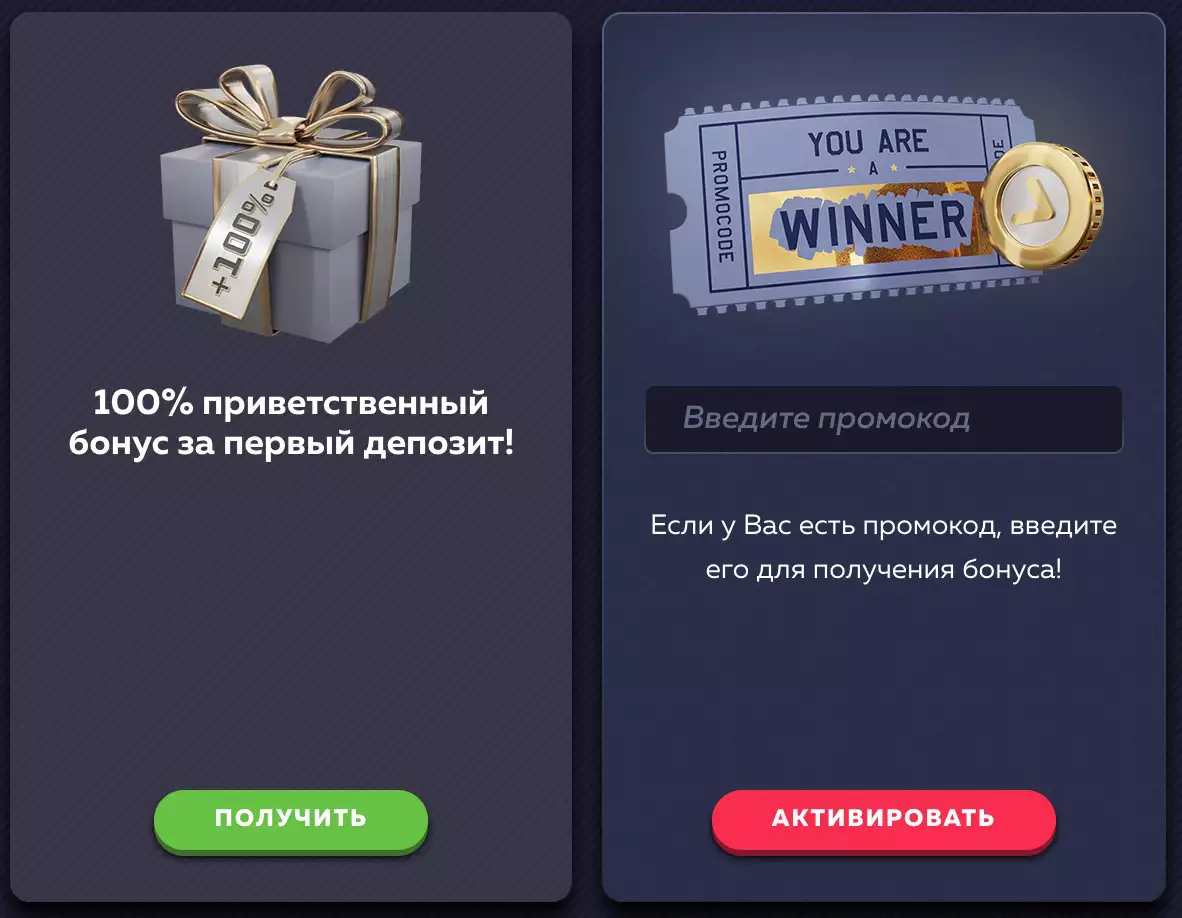

Двойной буст к депозиту

Чтобы отыграть бездеп, требуется пополнить игровой счет. В эту минуту активируется второй подарок казино, который удваивает сумму взноса. Единственное условие — она не должна быть ниже 1$ и превышать 1000$. Прибавка обеспечивает ставки в любых слотах и настолках, сорванный куш нужно отбить с вейджером х35. Период действия бонуса — 14 дней.

Персональные бонусы Вавада

Вознаграждения в виде кодов с зашифрованными спинами и денежными бустами предоставляются активным гемблерам. Они выступают в роли призов в промоакциях, подарков на День Рождения и поощрения за расходы на геймплей. Актуальный промокод Вавада на сегодня можно скопировать в новостной рассылке и во время стримов партнеров портала.

Кэшбек Vavada

Процент от потраченных средств получают исключительно проигравшие геймеры. Этот факт определяет статистика бетов и заносов, которая ведется для каждого пользователя на протяжении 30 дней. Утешительное вознаграждение формируется в размере 10% от суммы расходов и начисляется на бонусный баланс. Кэшбэк разрешается использовать без ограничений, отыгрыш требует выполнения коэффициента х5.

Играть в Вавада на Android и iPhone

Сегодня Vavada Gaming проходит не только в десктопе, но и в любом переносном устройстве. Для его запуска игроки скачивают независимое приложение на свой смартфон или планшет, регистрируются или авторизуются в системе. После этого пользуются следующими удобствами мобильного софта:

- Широким функционалом. Интерфейс и функциональные возможности идентичны браузерной версии.

- Отсутствием блокировок. Программа сама подыскивает рабочие зеркала.

- Полной игротекой. Если скачать Вавада на телефон, то все симуляторы и лайвы будут запускаться при подключении к любой сети интернет без потери качества графики и остальных характеристик.

Приложение займет в памяти айфона всего 35 мб, не вызовет затруднений эксплуатации и надежно защитит девайс от вирусных атак.

Игровые автоматы казино Vavada: выбор развлечений на любой вкус

В игротеке собраны самые разнообразные игры, которые предоставляют лучшие разработчики азартных аппаратов. В каталоге симуляторы классифицируются по популярности и новизне. Первые заслужили внимание ценителей отдачей от 95-96% и увлекательным игровым процессом. Вторые предлагают совершенно новые сюжеты, современный функционал и разнообразие раундов в погоне за выигрышами. Такие варианты присутствуют в каждом из четырех разделов коллекции развлечений.

Слоты

Это самые интересные игровые автоматы casino Вавада, поэтому их подборка наибольшая среди других видов игр. Чтобы выиграть, гемблеры запускают барабаны, в поле которых располагаются разные символы. Выпадения определенной комбинации умножает ставку пользователя в два или в несколько тысяч раз. Увеличивают шансы таких совпадений вайлды — они заменяют любой символ на игровом поле. Если появляются скаттеры, включается бонусный раунд. Он дает повышенные множители и такие функции как лавина, статичные символы и фриспины. Прибыль в таких турах увеличена в разы.

К топовым слотам относятся:

- Extra Chilli — 96,82%.

- Royal Potato 2 — 96,31%.

- Road Rage – 96,03%.

- Minotaurus — 96%.

- Gates of Olympus 1000 — 95,51% и многие другие.

Столы

Это настольные развлечения с виртуальными дилерами, стратегии с краш-сюжетом и игры на интуицию. Их правила отличаются в зависимости от вида настолки. Например, в рулетке игрокам требуется сделать ставку на цвет или цифру, которые делят колесо на секторы и дождаться совпадет ли она с результатом вращения. Если пользователь запускает автомат наподобие Aero или Space XY, то нужно вовремя снять умноженный кэш, пока не разбился самолет. В таких столах как Dogs' Street геймеры кормят собак, а в Fury Stairs — обходят огненные всполохи, чтобы увеличить ставку.

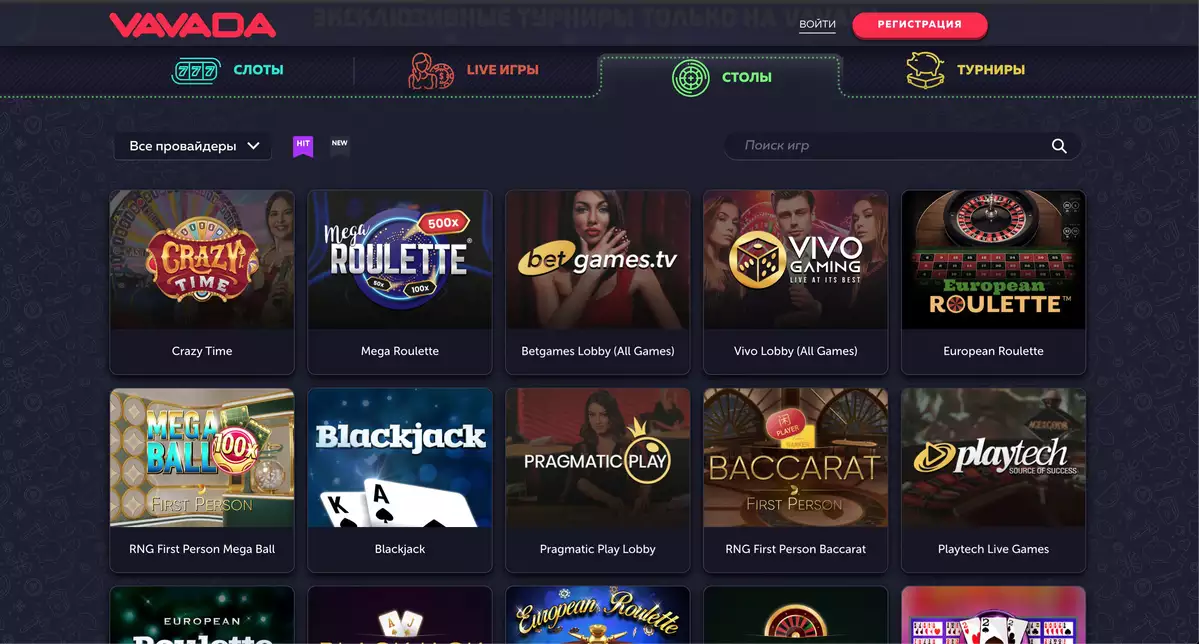

Live games

Исключительный гемблинг предлагают лайв в Vavada com. Это онлайн-эфиры настолок с настоящими дилерами, которые проводят игровой процесс в оборудованных студиях. Их предоставляют пять провайдеров:

- Evolution.

- Pragmatic Play.

- Playtech.

- Betgames.

- Vivo Gaming.

В их лобби ежесекундно запускаются трансляции монополий, рулеток, кено, несколько видов блэкджека и баккары, адаптированные под live-режим хитовые слоты. Для ставок принимаются только реальные деньги. Их стоимость варьируется от пары центов до сотен долларов.

Турниры Вавады

Борьба за денежные призы происходит в барабанах и столах, список которых предлагает казино для каждого нового соревнования. По условиям состязания, соревнующиеся используют все слоты или только один, ставят валюту, чтобы сорвать заносы, либо применяют бесплатные спины. К платным соревнованиям таким, как Икс, Икс-Плюс и МаксБет допускаются все клиенты заведения, сражения за фриспины Вавада открыты исключительно геймерам по статусам.

Чтобы стать одним из победителей, необходимо немного везения, если требуется копить множители, или правильная стратегия ставок, когда в учет принимаются их суммы. Они заносятся в рейтинговую таблицу и определяют 100-150 лидеров. В качестве вознаграждения предоставляются фонды от 20000 до 65000$. Они распределяются между призерами неравномерно: первая тройка забирает суммы от 1000$ до 12000$, остальные 100-500$. Лидеры эксклюзивных состязаний за автомобиль становятся автовладельцами. В период от 21 ноября по 25 декабря прошли розыгрыши Мерседесов премиального класса. До Нового Года пройдет еще одно соревнование за внедорожник Gelandewagen. Присоединиться к сражению в формате МаксБет могут все.

Выводы

Официальная платформа и рабочее зеркало Вавада ru предоставляет шанс играть на лояльных условиях и срывать куш с уверенностью его последующего извлечения на карту. Эта возможность требует лишь регистрации, которая займет не более пяти минут. Если нет времени часами сидеть за компьютером, скачивайте мобильное приложение и запускайте барабаны в свободную минуту. Нет желания тратить деньги на развлечения, можно проводить досуг в бесплатных демо-версиях. Управляющая компания предусмотрела все факторы для приятного гемблинга.

Официальный сайтFAQ

Как вывести бонусы с Ваваду?

Для начала их следует прокрутить, применяя реальную валюту. Пополните счет на сумму равную выигрышу с учетом коэффициента. Потратьте пополнение в любых симуляторах, пока бонусный счет не переместится на депозит.

Vavada казино как отыграть бонус Maneylocky Space?

Условия отыгрыша отображаются в соответствующей вкладке персонального кабинета.

Как долго выводятся деньги с Вавады?

На извлечения средств с игрового баланса обычно нужно не более 2-5 минут. Но случаются и задержки. Их время не превышает 24 часа.

Отзывы

-

На Vavada не о чем волноваться. Интерфейс, игры и кошелек работают как часы.

-

Не парюсь с зеркалами. Скачала приложение на комп и пользуюсь им без ограничений.

-

Я заядлый геймер. Провожу много времени на портале и доволен сервисом. Если хотите не просто юзать слоты, а выигрывать — присоединяйтесь к клубу.

-

Есть казино, где бонусы побольше. Но здесь кэшаут намного быстрее работает, поэтому остановилась на Вавада.

-

В игротеке появился прикольный барабан Santa Mummy. Волатильность 8 из 10, Big и Epic Win на девяточку, отдача 96,3%. За минуту 75К поднял!